Contents:

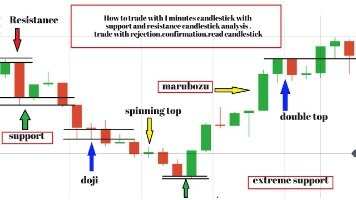

When the price of an asset approaches a support level, buyers tend to step in and push up the price; conversely, when it reaches a resistance level, sellers can be expected to drive the price down. By identifying such levels, traders can plan when to enter or exit the market. The first one is the symmetrical triangle which forms as support and resistance boundaries converge. This formation usually represents periods of low volatility, with prices expected to break out in either direction when one of these boundaries is breached. The second distinctive pattern is the double top or bottom which occurs when a support or resistance level is tested multiple times.

Of course, there are new editions, but checking their reviews first is essential to ensure you are spending your time on proper learning material. The academies and learning sections in the sites of the leading brokers are another good shout. Packed with lots of valuable content, they can give you a good start with technical analysis and help set a solid foundation for further learning. For those just starting, learning technical analysis from the ground up might seem like a mountain to climb. And rightly so – mastering technical analysis requires years of dedication, focus, patience, and willingness to improve and continuously acquire new skills.

This active management technique is designed to give advisers the information they need to make decisions for their clients, organizations, and themselves. The more correct technical analysts are about future price changes, the better they can manage wealth for all stakeholders. Modern technology helps to make those predictions more accurate than ever before. The first step is to learn the basics of investing, stocks, markets, and financials. This can all be done through books, online courses, online material, and classes.

BROWSE COURSES

If a stock is uptrending all day with no signs of a reversal and you try to short it, you are setting yourself up for failure. Similarly, if a stock is downtrending and you keep trying to “catch the bottom” by taking a long position, you are exposing yourself to unnecessary risk. If, on the other hand, you’re serious about building personal wealth or becoming a financial advisor, you could be a few short years away from a lifetime of profitable investments.

And besides, if you want to earn your CMT accreditation, the largest professional prize in the field of technical analysis, you must buy and study three thick books of curriculum material. It used to be that Chartered Financial Analysts didn’t have to know much about the technical side of investment forecasting. But because of the renaissance that technical analysis has experienced in recent years, CFAs are doing all they can to stay ahead of the curve. It’s important to note, trading or investing in securities comes with a great deal of risk. The Finance and Quantitative Model course is great for those looking to combine technical analysis to the underlying financial performance of a security. Technical analysis reviews the historical performance of a securities chart and based on that prior performance/behavior, looks to predict how the market will react.

The higher a https://trading-market.org/ average number is, the more significant price movement in relation to it is considered. For example, price crossing above or below a 100- or 200-period moving average is usually considered much more significant than price moving above or below a 5-period moving average. The dragonfly doji, when appearing after a prolonged downtrend, signals a possible upcoming reversal to the upside. Examination of the price action indicated by the dragonfly doji explains its logical interpretation. The dragonfly shows sellers pushing price substantially lower , but at the end of the period, price recovers to close at its highest point. The candlestick essentially indicates a rejection of the extended push to the downside.

Learn Something New

So it can be challenging to find resources related to technical analysis. Technical indicators are mathematical calculations based on the price, volume, or open interest of a security or contract. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

Those willing to pay for structured content from a lecturer and be granted a certificate can consider paid online and offline courses. At University of the People, we offer tuition-free degrees in Business Administration. Since all courses take place online, you’ll have the flexibility to study from anywhere you’d like.

Trading the Gap: What are Gaps & How to Trade Them? – DailyFX

Trading the Gap: What are Gaps & How to Trade Them?.

Posted: Tue, 15 Nov 2022 16:37:21 GMT [source]

While there is no shortcut to success, aspiring traders can build a knowledge base and get a feel for the market over time that can provide an edge when trading. Technical analysts acknowledge that there are periods when prices move randomly, but there are also times when they move in an identifiable trend. Once a trend is identified, it is possible to make money from it, either by buying low and selling high during an upward trend or by selling short during a downward trend . By adjusting the length of time the market is being analyzed, it is possible to spot both short- and long-term trends. When learning Technical Analysis, traders can look at various indicators such as Moving Averages, Oscillators, and Support and Resistance levels to gain insight into market sentiment. Moving Averages are used to measure the average price over a certain period of time.

Here is the list of India’s top Technical Analysis courses offered by the different stock market institute.

Learn how to approach technical analysis using charts, and how to analyse chart patterns to become more consistent in your trading. Moving averages do not predict price direction, but rather define the current direction with a lag. Moving averages lag because they are based on past price action – which is mainly why they are not a great short-term trading indicator. These concepts help to identify trends and reversals, measure an asset’s momentum strength, and determine areas where an asset can find support or resistance. If you’re a long-term trader, it’s important to know why a stock moves. It’s how you can better determine if it makes sense to hold on for a longer period of time.

Support and resistance levels are used to confirm the existence of a trend and to identify when the trend reverses itself. It is suited to people who seek to make money from securities by repeatedly buying and selling them rather than those who invest for the long term. Neeraj joshi’s YouTube channel is a great resource for anyone interested in learning technical analysis, earning money and starting an online business. He shares market insights on the stock market and how to become a successful businessperson, enabling viewers to become rich. As stock price movement is influenced by human interaction and interpretation of trends, as day traders, would it be best to then use the most common technical indicator?

Bar (HLOC) Charts

There’s so happening when you’re trading, it’s easy to forget things you can learn from. They only display closing prices linked to form a continuous straight line. It’s also important to know support and resistance areas when setting stop losses. Oscillators can signal possible trend changes by gauging a stock’s momentum. They also have upper and lower bands that indicate if a stock is overbought or oversold.

Learn Technical Analysis Skills to Master the Stock Market – Entrepreneur

Learn Technical Analysis Skills to Master the Stock Market.

Posted: Sat, 04 Dec 2021 08:00:00 GMT [source]

As you advance, you will be the judge of that but this book covers all you need to know about a very crucial part of best way to learn technical analysis analysis – volume price analysis. Jack Schwager compiles for us a series of interviews with the most respected stock and forex traders where they unravel reasons for failures or success. Experts will tell you that you will not go far in Stock trading if you are not in control of your emotions and this book is one of the best technical analysis books that handle that issue.

Top Technical Analysis Tools

The Structured Query Language comprises several different data types that allow it to store different types of information… Investopedia’s Technical Anlaysis course has taught me a lot of new information and is also reinforcing my prior knowledge on trading. I am even applying the knowledge I gained from this course to my cryptocurrency trading.

- Once again, you never actually have to do any of these calculations.

- By identifying such levels, traders can plan when to enter or exit the market.

- Crypto Notes is a YouTube channel providing helpful learning resources for crypto enthusiasts interested in technical analysis.

- If you want to learn profitable intraday trading strategies, “Intraday Trading Course” by Nifty Trading Academy is appropriate for you.

- They can select the charts as per their convenience, whichever would help them form their strategy.

- He has held positions in, and has deep experience with, expense auditing, personal finance, real estate, as well as fact checking & editing.

Umesh sir has explained all the concept in a very simplified way. I trade with full confidence and has improved my trading skills & strategies.” These 15 best books for technical analysis are not the be-all and end-all to technical analysis. Knowledge never ends, and seeking knowledge is a lifelong endeavor. From experience, after recommending this list of books for technical analysis, we get a myriad of questions from newbies about technical analysis and the books.

You can learn technical analysis from several places, including books, online and offline classes, educational websites and broker academies, and even Youtube. In this bottom-up approach, analysts are looking for undervalued stocks and securities or ones that are going against market trends. For example, analysts might take a top-down approach to how a stock performs over a determined period of time. First, they’ll analyze it on a daily basis, and then they’ll narrow it down and look at the performance per hour.

Aside from the hundreds of technical analysis-related articles, it also offers a dedicated paid course. If you prefer to stick to online learning and are willing to pay more for quality content, there are professional courses with certificates from renowned organizations as well. You can enroll for a technical analysis trading course from a top-tier institute and ensure the flexibility to learn at your own pace from the comfort of your home.

The Best Swing Trading Books for Learning How to Trade … – Business Insider

The Best Swing Trading Books for Learning How to Trade ….

Posted: Thu, 16 Feb 2023 08:00:00 GMT [source]

However, if you’re more interested in the business side of things instead of the actual analysis, you might benefit from studying in a field that is more focused on best business practices. There’s a lot more that can be discussed about technical analysis, but hopefully, this gave you a good introduction to the field. In fundamental analysis, the measurement is based on the intrinsic value of a stock. Fundamental analysis also looks at a lot more factors, such as the economy as a whole, current conditions in the industry, as well as company-specific information like sales, earnings, and assets. Just like anything else, there are advantages and disadvantages to using technical analysis.

Dow believed that the stock market was a dependable measure of economic conditions. He thought that by examining the market as a whole, analysts could more accurately assess conditions and identify market trends … even for individual stocks. By looking at the data, traders can make intelligent decisions on what’s likely to happen with the stock … They can even see how investors’ emotions and market psychology play a role in stock movements. In short, this is how you look at a stock’s movements, the overall market, and learn to recognize patterns using historical data.

Technical Analysis consists of various types of charts viz Candlestick, bar charts, Line graphs, point & figure charts, Heiken-Ashi chart, etc. Amongst these charts, the most commonly used is the candlestick chart as it helps in identifying various candlestick patterns, which are used to generate trade signals. Unlike fundamental analysis, which attempts to evaluate a security’s value based on business results such as sales and earnings, technical analysis focuses on the study of price and volume.

Here is an example of we use technical analysis at Investors Underground. Our content is free to consume and most of the time we do not earn revenue from publishing articles. In some instances, clicking on links in articles may earn us a commission if you are to purchase something. The course is taught by JC Parets, who is a well known and respected technical analyst. Whenever you invest or trade securities, you are risking your own money with the desire to make more money.